With cap rates on some multi-family buildings in Tokyo now in the 3% range, furnished or short-term say rentals in Tokyo are an appealing tactic for investors looking to squeeze out some higher rents. We have sourced a few of these options recently that are available for purchase while still under construction.

Still, finding multi-family apartment buildings suitable for conversion to short-term accommodation is easier said than done. Most investment properties are sold tenanted with long-term tenants under ordinary, renewable leases. Japan’s strong tenant laws mean a landlord cannot evict or refuse to renew at renewal time, and rents or rental terms and conditions cannot be changed once a tenant is in place. Japan’s stable, low tenant turnover, can be a double edged sword.

That leaves two options:

- Buy pre-completion

- Source land and develop

Buying pre-completion, or during the construction phase, tends to be the preferred choice for many investors. It’s a short cut and offers less hassle. But, there may not be much flexibility in planning and design. Some buildings may have been designed with awkward layouts that may not have been designed for short-term stays.

Sourcing land and developing yourself will allow full freedom over design and planning but this is a multi-year approach and requires a strong and experienced team on the ground.

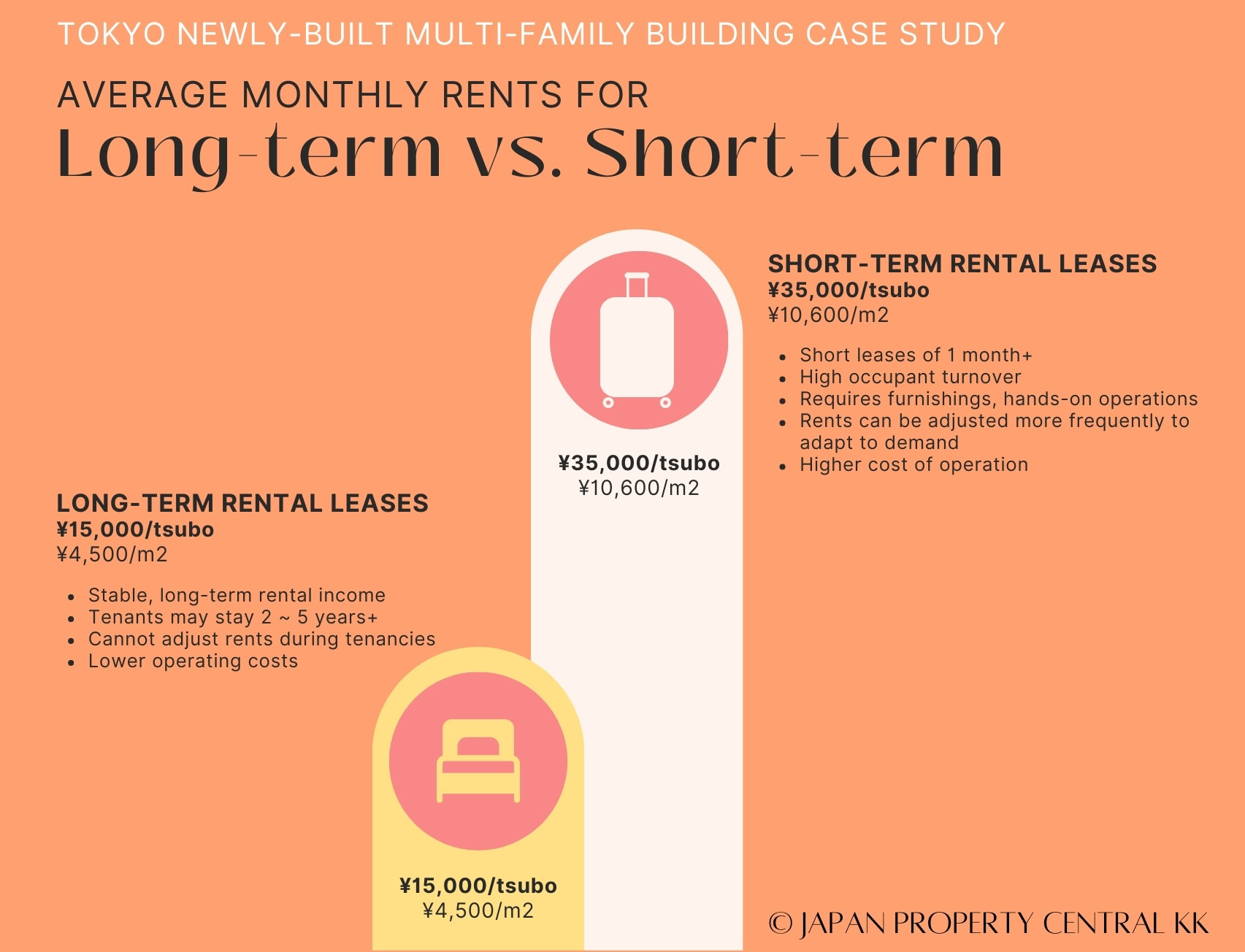

How do the rents differ?

Based on data collected from one neighborhood in central Tokyo, the monthly rents for the ordinary, long-term apartments average around 15,000 Yen per tsubo (4,500 Yen/m2). For furnished, monthly stays in the same neighborhood, the average rent is closer to 35,000 Yen per tsubo (10,600 Yen/m2). Note that short-term properties do come with higher operating costs and can have varying vacancies between stays.

![]()