Annual land values were announced on Tuesday and the return-to-work trend, recovery in inbound tourism, and a dispersal of attention away from Niseko and towards other cheaper ski resort destinations is apparent.

On March 26, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced the results of the nationwide assessed land values (koji-chika). The average value across all land uses increased by 2.3%, reaching the highest level seen since 1991. This is an accelerated improvement from the 1.6% growth seen in 2023 and the 0.6% growth seen in 2022. Residential land values increased by 2.0% and commercial increased by 3.1%.

Tokyo

The larger Tokyo region, including Tokyo, Saitama, Chiba, Kanagawa and Ibaraki, saw land values across all uses increase by an average of 4.0%. This is the 3rd year to see an annual increase, and is 1.6 points greater than the increase seen in 2023.

Some of the greatest increases were seen in central Tokyo locations as well as key train stations as residents seek out convenient locations either close to or with a convent commute to their workplaces. Tokyo’s 23 wards saw a 5.4% increase in residential land values.

The most expensive residential land in Japan is in Akasaka where a survey site has a land value of 5.35 million Yen per square meter. The land is up 4.5% this year, up from a 2.4% increase in 2023. It’s a particularly wealthy residential neighborhood with embassies, luxury hotels, and high-rise developments going up nearby. The recently opened Azabudai Hills project down the street may also have helped to push up land values further.

Commercial land values in the 23 wards increased by 7.0%, accelerating on a 3.6% increase seen in 2023. The most expensive commercial land in the country is under the Yamano Music Building in Ginza. The latest valuation has it at 55.7 million Yen per square meter, up 3.5% from last year. Ginza has benefitted by increased consumption by wealthy domestic shoppers, along with a return in foreign tourism.

Asakusa has been a prime beneficiary of the swiftly recovering inbound tourism sector, with the top five increases in commercial land sites in Tokyo all located in Asakusa. Those survey sites saw annual increases of between 15 ~ 18%. Visitor arrivals in January and February of 2024 totaled 5.476 million, 3.4% higher than the total for January and February of 2019.

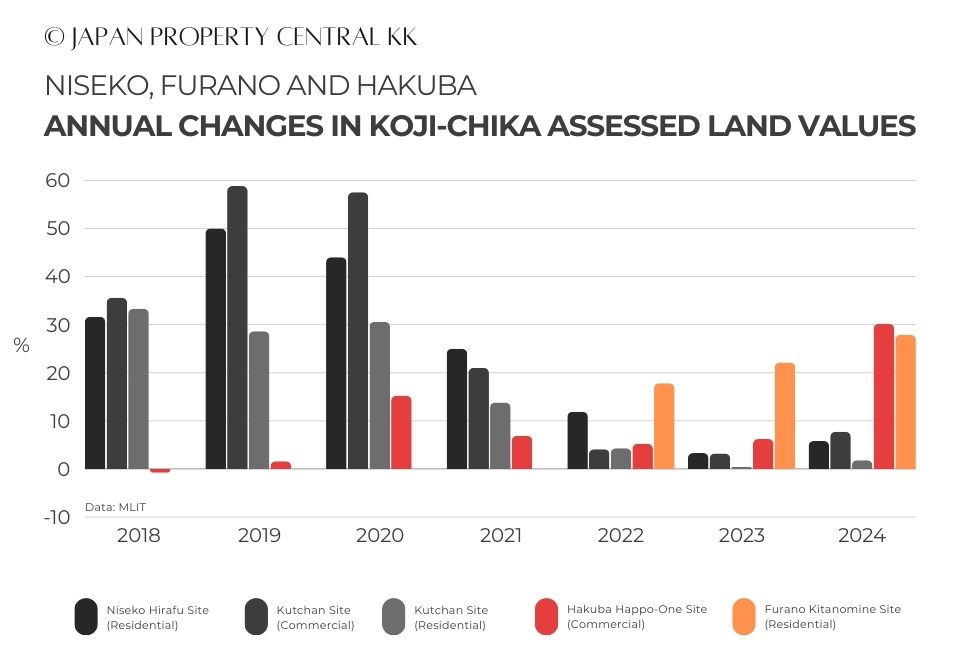

Furano and Hakuba out-perform Niseko

Nationwide, the largest increase in residential land values was in the up-and-coming ski resort town of Furano in Hokkaido. A site in Kitanominecho near the ski slopes saw a 27.1% increase. This town has been attracting both a growing number of skiers and foreign developers attracted by its lower land prices than Niseko.

A residential survey site in Kutchan saw a 1.8% increase in land values in 2024 following a mild 0.4% increase in 2023. This is far more subdued than the 30% annual increases it was experiencing between 2018 and 2020. A commercial site in Kutchan saw a 7.7% increase this year after 3.2% growth in 2023, but this same site saw almost 60% annual growth in 2019 and 2020.

A commercial site near the Happo-One ski slope in Hakuba, Nagano Prefecture, saw a 30.2% increase in land values this year, after 6.17% growth in 2023. Hakuba has also been attracting an influx in developer interest. Late last year, Banyan Tree announced plans for a 156-room hotel near the Happo-One ski slopes with a tentative open scheduled for 2026. This will be the first Banyan Tree in Japan. Back in 2022 there were plans for a hotel in Niseko, but the development was cancelled in July 2023. While Niseko is highly dependent on foreign travelers, Hakuba has historically had a better mix of domestic and foreign visitors. It benefitted during the pandemic due to its relatively easy access from Tokyo, making it within reach of 44 million domestic residents.

![]()