The Real Estate Economic Institute published a recent report looking back at Japan’s condominium-type apartment market over the past 50 years. The country has experienced a number of economic cycles over the past five decades, including the 1970s oil crisis, the 1980s asset bubble and subsequent crash in the early 1990s, oversupply of new condos between the mid 1990s and mid 2000s, the 2007-2008 global financial crisis, and, more recently, over a decade of loose monetary policy and low interest rates.

There have been several noticeable shifts in the condo market across Japan, and especially in Tokyo.

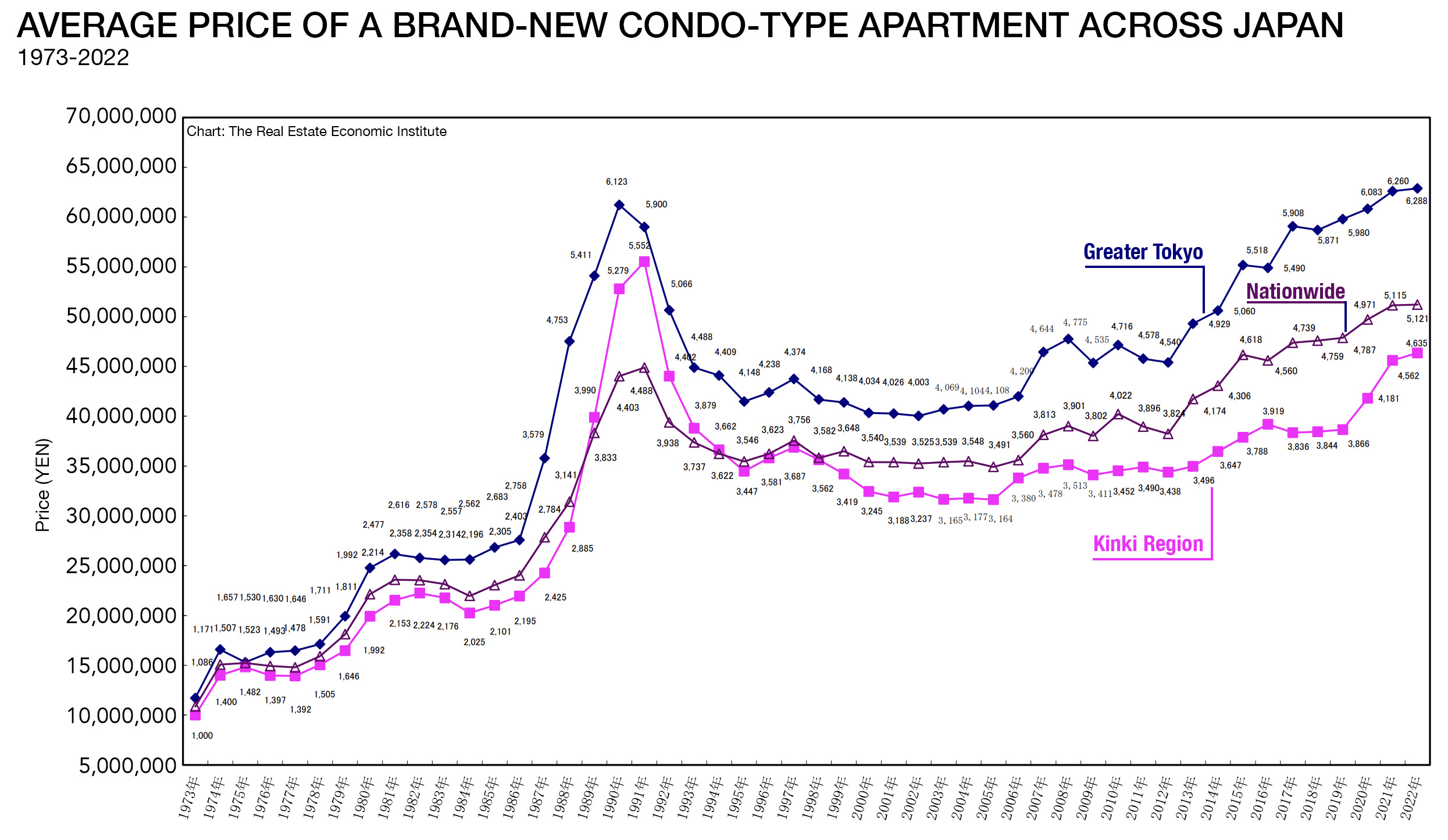

PRICING

The average price of a brand-new apartment in greater Tokyo, which includes Tokyo, Kanagawa, Chiba and Saitama, was 62.88 million Yen in 2022, a 5.4-fold increase from 1973 when the price was just 11.71 million Yen. The nationwide average has increased by 4.7 times to 51.21 million Yen. Both the nationwide and greater Tokyo prices in 2022 were the highest on record, while the Kinki Region, which includes Osaka, remains 16.5% below its peak of 55.52 million Yen recorded in 1991.

APARTMENT SIZES

While the average apartment size for greater Tokyo has increased by 19.0% to 66.12m2 (711 sq.ft) over the past 50 years, the average size in Tokyo’s 23 wards has increased from 42.01m2 in 1973 to 63.96m2 in 2022.

ANNUAL SUPPLY

The annual supply of brand-new condo-type apartments in greater Tokyo was 29,569 units in 2022, 20.9% lower than the supply in 1973. Nationwide, 72,967 apartments were supplied in 2022 vs. 93,778 units in 1973. The total national supply over a 10-year span peaked at 1.61 million units between 1993 and 2002. Between 2013 and 2022, the total supply was 780,000 units, the lowest over the past five decades.

Source: The Real Estate Economic Institute, December 14, 2023.

![]()